Quick read

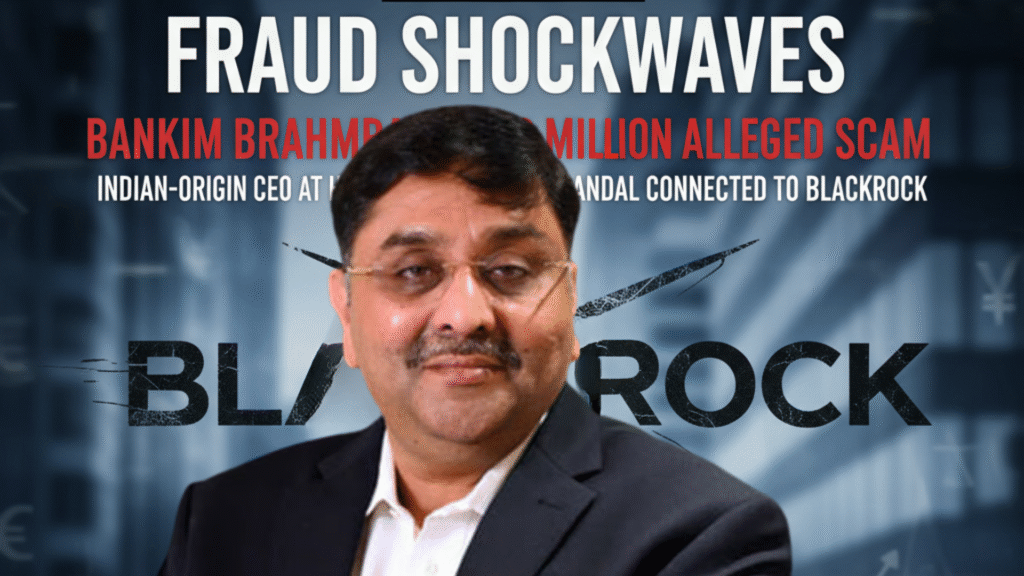

- Bankim Brahmbhatt, an Indian-origin entrepreneur and CEO of several U.S. telecom-services firms, is accused of orchestrating a loan fraud scheme exceeding US $ 500 million.

- The alleged fraud was aimed at BlackRock’s private-credit arm (via HPS Investment Partners) and other global lenders.

- The scheme reportedly involved fabricating accounts receivable and customer contracts, pledging them as collateral for large loans.

- Brahmbhatt’s companies, including Broadband Telecom and Bridgevoice, filed for bankruptcy in August 2025; his personal bankruptcy was filed the same day.

- His current location is unclear; legal actions are underway for asset recovery and potential further liability.

What’s the case about?

Brahmbhatt stands accused by BlackRock’s HPS Investment Partners and co-lenders of setting up a sophisticated deception: his telecom-service companies allegedly created fake invoices, fictitious customers, and bogus contracts going back to 2018, then used those as the basis for large loans secured by receivables that didn’t exist.

According to court filings, the credit-funding began in September 2020, growing to roughly $430 million by August 2024. Then, in July 2025, the first red flags appeared when HPS staff discovered email addresses used to verify receivables were fake domains impersonating real telecom companies.

Who’s involved & where does it stand?

- Brahmbhatt & his companies: He runs Broadband Telecom, Bridgevoice and related financing arms such as Carriox Capital II. These firms have declared bankruptcy.

- Lenders: BlackRock’s HPS arm, backed by institutions including BNP Paribas, financed the loans. BNP Paribas is reported to have funded nearly half of one large tranche.

- Legal status: The lawsuit was filed in August 2025. The scale of alleged unpaid loans is cited at “more than $500 million.”

When & how did it unfold?

- September 2020: HPS begins lending to one of Brahmbhatt’s financing entities.

- 2021–2024: Loan commitments escalate (to ~$385 m in 2021, ~$430 m by August 2024).

- July 2025: An HPS employee flags inconsistent email domains during due diligence.

- August 2025: Bankruptcy filings for the companies and for Brahmbhatt himself.

- October 2025: Media report reveals the full scale of alleged fraud and global recovery effort.

Stay connected with Unwires.com for more such news, geopolitics, bollywood stories, guides, and inspiration. After all, every great journey begins with a spark — and Unwires is that spark. ⚡